Let's reach new heights together

Gleneagle is an Australian Financial Institution.

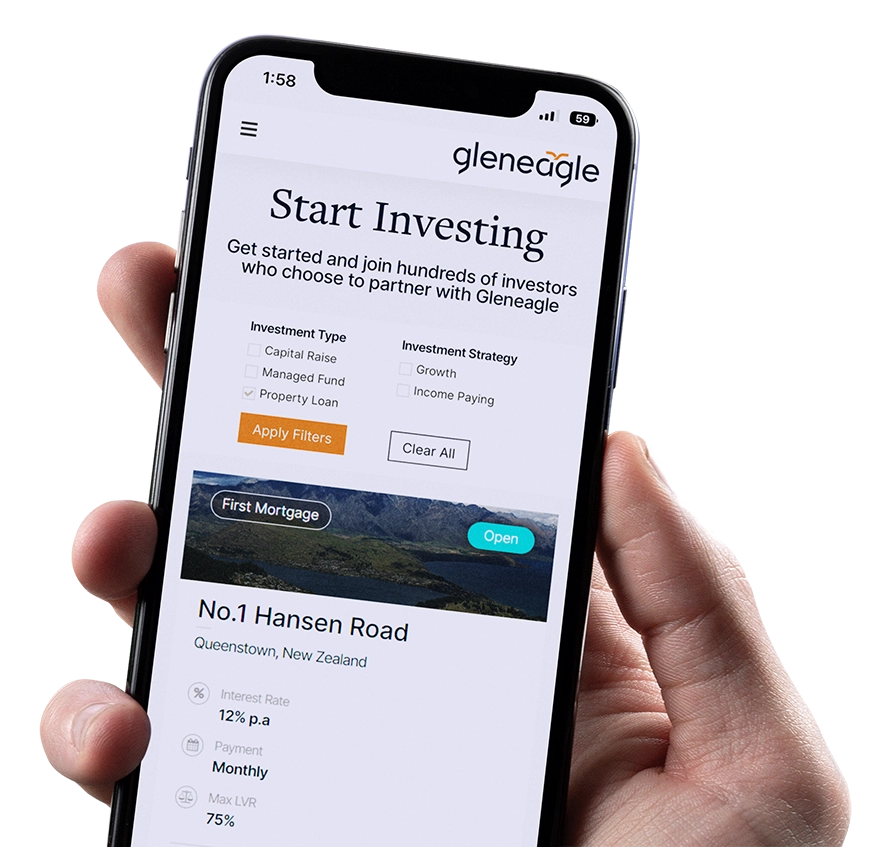

We’re unlocking the exclusive world of investment banking for individual investors.

Secured Property Loans

Capital Raises

IPOs

Fixed Interest

Managed Funds

Equity Growth

Unlock Exclusive Opportunities

Typically, certain high yield investments are only transacted between financial institutions and those within the inner circle of the industry.

Gleneagle gives you access to the same investment vehicles we use for our own capital.

Source

Qualify

Due Diligence

Monitor

Exit

Invest Like a Bank

Investing is our core business.

Every deal is subject to our extensive credit assessment, compliance, and underwriting conditions. Each year, only a select few meet our strict criteria.

We only present you with the deals we’re confident having in Gleneagle’s own portfolio.

Aligned Interests

We form partnerships with individual investors, to collectively redeem superior opportunities and returns.

The Difference

Unlike many other platforms, all deals put forward are coinvested by us.

We are greater than the sum of our parts. Partnering with investors allows us to reach new heights together.

708 Club

These deals are often extremely time sensitive and subscribed well before public distribution.

Insights

Watch as we put company executives through their paces in exclusive interviews.

Witness our market analysis and selection criteria, as we cherry-pick which companies to work with.

Get Started

Individual Opportunities

Gleneagle selectively works with companies seeking to conduct IPOs, placements, capital raising, and debt funding, across a variety of industries.

Managed Funds

Trading

Understanding your portfolio and broader financial objectives is imperative when formulating a measured wealth management strategy.

Gleneagle’s Trading and Advisory team work with you one-on-one to educate and empower you in your investment decision making.

Our investors trust us with over

As of June 2023, Gleneagle and its related parties work with ~56,000 clients, and hold ~$1.18B in Funds Under Management and Advice.