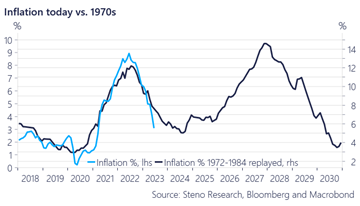

The top 7 stocks in the US, now called the ‘Magnificent 7’, accounted for nearly all the gains in the S&P 500 in 2023. When we plot the top 7 stocks in the S&P 500 against the remaining 493 stocks for the year, you can see the outperformance of these top names. Essentially, anyone not in the top 7 names underperformed. The question is ‘’will this outperformance continue?’’

Source: Apollo via Twitter

Looking forward, conditions for further gains in the broad equities remain, although I believe we are likely to see rotation out of these top 7 names into other sectors. The top 7 names, while great businesses, are getting very expensive on many metrics. It thus follows that on a relative basis, the other names start to look much more attractive. This then sets up a feedback loop as the other stocks and sectors start to rise, positive momentum tends to drive further gains and this is what drives the rotation.

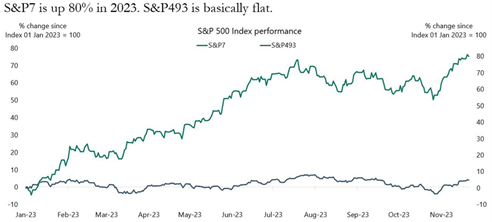

The US recession that many were predicting in 2023 (including myself) didn’t eventuate, and with inflation continuing to come down, rate cuts are now being priced into the market. This is good news for equities. We also had the fastest easing of financial conditions in history over the last 2 months, and, unsurprisingly, this provided a bullish backdrop. Given that 2024 is an election year, I believe the Fed will continue their easing stance to support equities.

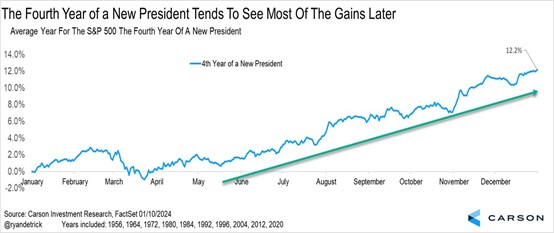

Historically, election years are bullish, although the gains tend to happen from the middle of the year.

Source: @RyanDetrick via X.com

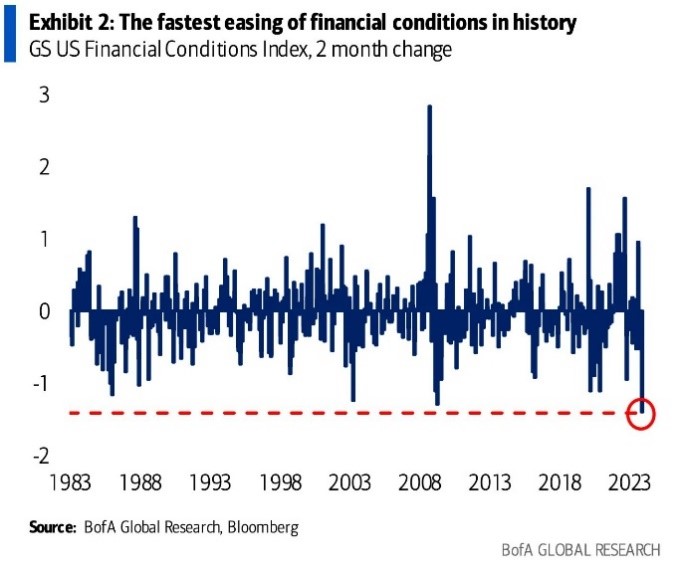

The main risk to equity markets in 2024 is likely to be a rebound in inflation. The following chart shows the waves of inflation seen in the 1970’s, and the pattern is surprisingly similar at this stage. History has a way of rhyming, although right now we are not seeing any sign of the 2nd surge.