June can be a tough month for any equities that have underperformed over the financial year as they can be subject to tax loss selling, where investors sell weaker stocks to offset any capital gains they may have had for the year.

Interest Rates

While the RBA just paused again on rates, global interest rates continued to rally in June with the FOMC minutes still indicating more interest rate hikes are in the pipeline. Fortunately, many inflation measures are likely to slow down significantly into the end of the year which is likely to take pressure off further rate hikes.

The only sticking point is that US services inflation excluding energy is still ~6.5% and unlikely to come down, especially as most of it is driven by a strong labor market. The US labor market is very tight, with unemployment at just 3.6%, which is historically very low against the long-term average of around 5.7%

We have also discussed what MI2 Partners Julian Brigden has termed ‘’the hyper financialization of markets’’ – the feedback loop between stock prices and the real economy. One would think that the real economy should drive employment, but this is not the case. Equity markets lead employment by around 3 months, and the correlation is very high at over 90%. Put simply, employment is now a response function of CEO behavior, since CEO’s are literally rewarded for higher equity prices. As stock prices rise, they increase capex spending which drives further employment. When the labor market is tight, this puts upward pressure on wages which further drives wage inflation. The only way for the Fed to get unemployment to rise will be for the FED to get equity prices lower.

So, we are in an interesting situation where market participants are expecting rates to start coming off which will be supportive of equity markets. But if equities continue to rise, this is going to put further pressure on an already very tight labor market, which will drive wage inflation and thus keep the service part of the inflation measure high. We are in an epic tug of war between bonds and equities.

This backdrop certainly raises the possibilities that we are in a period of calm before the storm, as despite many inflation measures falling, the FED is likely to keep rates higher for longer and keep reducing liquidity until something breaks.

Elsight

There was a very positive development in Elsight last month and given I haven’t spoken about it for some time so thought I’d give a detailed update.

It has been my experience that the best time to own these early-stage companies is in the 6-12 months before they go from negative cash flow while in the developmental stage to cash flow positive. This inflection point is the time when investors stop discounting more capital raisings or business failure

and start pricing in growth. It’s at this point a stock can put on multiples of its market capitalization in a very short amount of time. Knowing when this inflection point is about to happen isn’t always easy and to be fair, we have been early. However, I am gaining more conviction that we are now within 6 months of Elsight reaching breakeven. Last time the CEO was in the Gleneagle Sydney office around December he suggested they would be cash flow positive in the 3rd quarter this year.

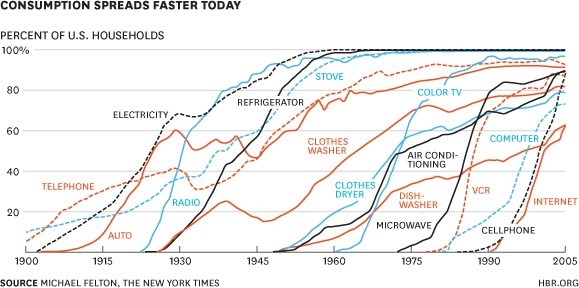

Any new technology normally experiences S-curve adoption. The growth starts as trickle at first, when builds slowly, then rapidly gets adopted before tailing over as it becomes ubiquitous. This pattern has repeated many times throughout history as the following chart shows.

“Any sufficiently advanced technology is indistinguishable from magic”. Drone delivery is one of these technologies that seemed like science fiction a decade ago but given the advances in AI vision, battery technology, GPS and secure connectivity, it is now looking to become common place as the cost savings of using a drone (~$1) vs a delivery driver (~$10) will drive the adoption. Drones should also be able to win the ‘speed race’ from mouse click to ‘at your doorstep’ as they do not have to wait in traffic. Also don’t forget there is a strong global ESG drive as using drones will result in a massive reduction in the ‘delivery carbon footprint’.

Elsight’s Halo product is an AI-powered connectivity solution that virtually guarantees constant uptime and connection between drones and ground control stations. Their product will seamlessly switch between using Wi-Fi, 3G, 4G, 5G (even between different mobile carriers) and satellite signals to maintain a constant connection. Their solution also offers Remote ID which clearly identifies each drone… this will become a mandatory FAA requirement from September this year. At the time of writing, I have not come across any competitor to Elsight’s Halo, and Halo is rapidly becoming the industry standard for drone connectivity. Even when a competitor inevitably appears, there will be reluctance for existing companies to change. The reason is that companies that have embedded the Halo solution into their drones as part of Elsight’s design win strategy would require FAA re- certification if they changed and this is a process that is long and arduous.

A major reason for drone delivery being slow to takeoff has been due to FAA delays. This is a new technology, and the FAA’s biggest requirement is safety. Many of the drones will be flying beyond the visual line of site of any operator (BVLOS). In June we saw the U.S. House of Representatives Transportation and Infrastructure Committee pass the FAA Reauthorization Package, Securing Growth and Robust Leadership in American Aviation Act (H.R. 3935), by a vote of 63 – 0. The Act calls for the FAA to commit to timelines for a BVLOS rulemaking, UTM, and drone integration.

Essentially the US government is forcing the FAA’s hand to expedite the approval process. Currently most drone companies are operating using limited FAA waivers.

How will this FAA rule change impact just one of Elsight’s customers? Walmart, in partnership with Droneup, is rolling out drone delivery for 34 of Walmart’s ~4700 US locations. Drone delivery is currently only available for a 0.8-mile radius around the Walmart stores. Once they receive the BVLOS approval, they will be able to deliver to within an 8 to 10 mile radius. When you increase the radius of a circle by 10, you increase the area (and hence the number of customers able to receive delivery) by 100. Area = π r². Overnight, drone delivery for each of the current Walmart stores can increase by 100 times – this is the kind of catalyst for Elsight that most market participants have not thought about, and once the ‘penny drops’, Elsight stock price could rapidly rerate higher.

Elsight’s Halo also has other applications outside of the drone space. There are a lot of robotic applications such as autonomous trucking, sidewalk delivery robotics, warehouse robotics, medical and military applications. Essentially anywhere you need guaranteed connectivity, Halo could be used. Elsight raised AUD$8 million at the start of the year and at their current burn rate have more than enough cash for 12 months operation.

In June we saw a repeat order from Censys Technologies Corp, just one of Elsight’s 90 design win partners. While the order value was relatively small, I believe we should start to see regular orders like this from other customers that should continue to grow in both size and frequency. The FAA BVLOSS catalyst is obviously going to be a key milestone, but there are plenty of other customers where this is not a deciding factor. Once the market sees the path to breakeven, the price should start to improve.

This time last year Elsight had a handful of companies using Halo as their connectivity and security of transmission solution with one of two companies placing small initial orders based on the “design win” business model. Fast forward to their recent webinar, they now have over one hundred customers and a larger number than that testing. Recurring revenue has just begun. Directors have been buying each quarter, something we have not seen the previous 4 or so years. At a sub AUD$50 mill market capitalization for a company that has a key technological components to the one of the fastest growing sectors, we should be well rewarded.

Energy Storage

As the word moves towards a sustainable future, one area that is going to need to grow vastly over the coming decades is energy storage. Traditionally, this had been pumped hydro but due to geographical limitations, we are going to see an explosion in other methods such as batteries and even Hydrogen – which should be considered a form of energy storage. As the amount of intermittent renewable energy keeps rolling out, the world will need to be able to store the energy to be able to use it at time when the sun is not shining, or the wind is not blowing. If the world is to move to fully renewable by 2050, the amount of storage required is vast – it’s going to be a massive growth area.

I have been spending a lot of time researching the different technologies, and more importantly identifying the companies that are likely to emerge as the winners. In next month’s newsletter I shall discuss energy storage at length, the different technologies, and some additions to the portfolio that are likely to be the big winners in the sector.