October was a better month for equity markets. The US SP500 was up 7.9%, the tech heavy Nasdaq up 4.0%, and our local ASX200 was up 5.9%.

In last month’s newsletter, I’d actually stated it was our view that equity markets were likely to rally given that sentiment and positioning had become extremely negative. Calling a market direction correctly and actually making money isn’t always as easy as it sounds, especially in times of heightened volatility. Sharp and unpredictable movements (the definition of volatility) make it difficult to determine when a new trend is starting. It is not uncommon at the moment to find ourselves in profitable new positions and then to see all the profits evaporate in a matter of hours..

Volatility is like a naked flame. It attracts traders like moths, then burns them

Our system dictates that once a position gets into sufficient profit, we don’t let the trade turn into a loss. With increased volatility, it is therefore not uncommon to see many more ‘scratch’ trades as markets reverse back to our entry price. Good trades can become bad trades and then get worse. I’ve seen many a trader bend their rules to their peril to try and overcome the volatility. Capital protection is and always remains paramount.

Inflation and the Fed

The Fed is trying to regain control of inflation and their main lever is interest rates. At the start of November, the Fed hiked rates by another 75bps, their 4th 75bps raise in a row. Make no mistake, these are super-sized rate hikes and have been the main cause of the recent market weakness. The market is therefore laser focused on sniffing out when the Fed is likely to slow the pace of rate hikes. At the start of this month, we finally saw a glimmer of hope as the Fed stated: “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Economic theory states that interest rates take time to have an effect on an economy as there are long and variable lags. This was the first time the Fed had actually mentioned the lags, and this was taken as good news by the market. It means going forward, we are likely to see smaller rate hikes and are likely closer to the top in rates (aka the terminal rate). It makes sense that the Fed should wait and see what impact this has on the economy. If we see inflation data continue to come off the boil, this will add more weight for equities to rally.

Australia

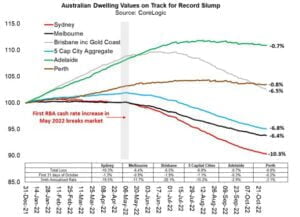

Locally, the RBA only hiked 25bps in their last meeting, also citing “The Board recognises that monetary policy operates with a lag and that the full effect of the increase in interest rates is yet to be felt in mortgage payments.’’ The RBA is likely concerned that the current housing collapse may continue to get worse.

One major difference between the US and Australia is in the US, most homeowners take out 30-year fixed rate mortgages so a change in interest rate has no impact on their repayments. In Australia, most people are on a variable or 1–4-year fixed rate (which subsequently reverts to variable). When the RBA hikes rates, our Banks follow almost immediately, so the effects are felt quickly.

The China reopening trade

At the start of the Covid pandemic, China locked down very hard and essentially became covid free. They then reopened while the rest of the world suffered and for a while it seemed they had come through the pandemic largely unscathed. However, China faces several problems:

- As covid has not spread through their population, there is no herd immunity

- Their current vaccine is ineffective

- There are political reasons against adopting a foreign vaccine

When covid cases started to rise this year, China made the decision to lock down again. Locking down large swaths of the population means people are not doing normal activities like building and manufacturing things. China is a major consumer of industrial commodities and energy, and during their shutdown, prices of these major commodities have become depressed.

As China reopens, their appetite for commodities will increase and we should see prices rise. Early signs are this is happening now, and we are getting big jumps in commodity prices. This is good news for commodity rich exporting countries like Australia and, as the reopening inevitably continues, this should also provide support for our miners and the Australian Dollar.