No.1 Hansen Road

Queenstown, New Zealand

Product Type

Property Loan

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Summary

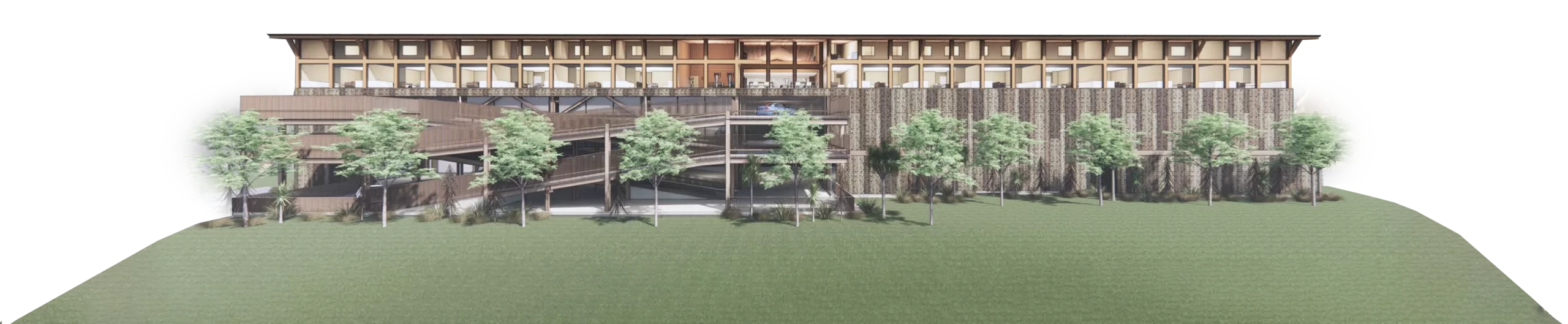

No.1 Hansen Road presents over 34,000m2 of prime vacant land in Queenstown NZ, set against the backdrop of the beautiful Remarkable Mountains.

Situated just 1.4 km from Queenstown Airport and a mere 12 minutes from Queenstown’s Centre, the site is ‘Local Shopping Centre Zoned’ as an appropriately located mixed-use centre that will provide for the community.

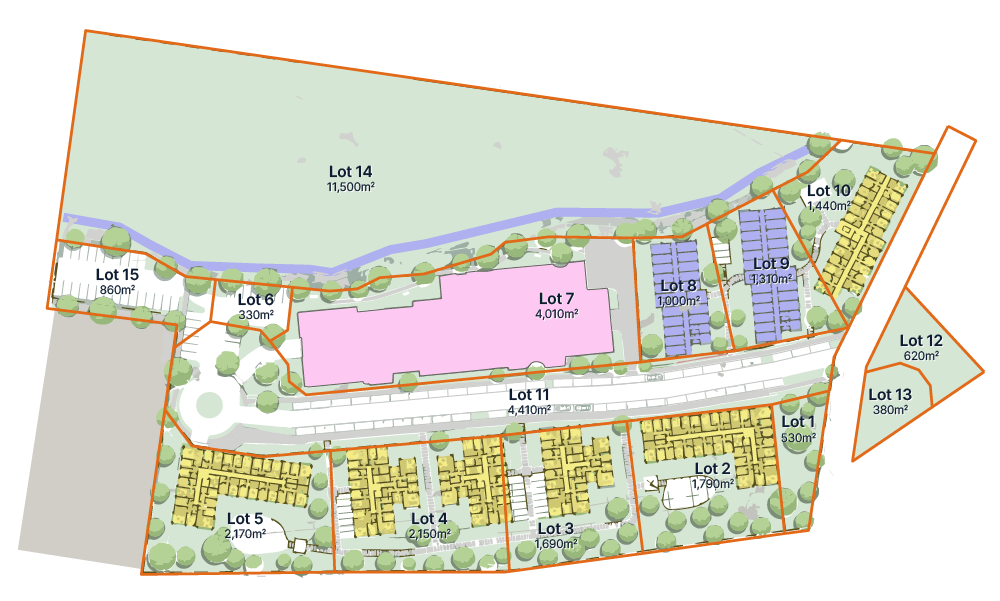

The property has been successfully approved for subdivision into 15 lots

The extreme shortage of worker accommodation in the Queenstown area is a well-known fact, with overcrowded rental properties, people living in cars, and hostel room rate cost escalation. Almost three quarters of Queenstown Lakes businesses have said the availability of staff accommodation is more than just a minor issue for their business*.

The spatial layout plan of the land at No.1 Hansen Road enables development to provide for a mix of residential, retail, offices, and car storage, which will provide for local residents and visitors, and assist with the economic viability of the area.

*Pulse check by Queenstown Business Chamber of Commerce, 30/31 January 2023, 82 respondents. Site plan indicative only

Sophisticated Investors

To be considered for this investment product; applicants must supply evidence they qualify as a Sophisticated Investor

Investment Terms

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Borrower | No. 1 Hansen Road Limited |

Property valuation | The property comprising 15 lots has been independently valued at ~$73.8m NZD, based on completion of the carpark building, including 2 upper floors of residential apartments, and the other subdivided lots as-is |

Investment Loan | Bridging Loan to support working capital during construction of Stage 2 (2 residential floors), and preliminary design and planning for Stage 3 |

Interest | 12% p.a., payable to investors monthly |

Loan Maturity | 30 September 2024 |

Max LVR | 75% |

Minimum Investment | AUD$50,000 (open only to sophisticated investors within the meaning of section 708(8) of the Corporations Act) |

Exit Strategy | Refinance with senior investment |

Loan Repayment | Early repayment allowed |

Loan Security | 2nd Ranking Secured Loan Facility comprising an all asset charge over the Borrower, behind land and construction finance of up to $40m NZD |

Product Code | HANS12P2309 |

Project Plan

Subdivision of the lots and ‘The Carparks at No.1’ (Lot 7)

Additional Residential Floors (Lot 7)

Worker Accommodation

Project Progression

2024 Onward

October 2024

September 2024

January 2024

December 2023

Approval for Stage 3 anticipated to be issued

New loan facility now open to investors

New loan now open to investors

Proceeds used to support working capital during construction of Stage 2 (2 residential floors), and preliminary design and planning for Stage 3

August 2023

February 2023

October 2022

July 2022

Infrastructure and siteworks commenced

June 2022

Fixed price contract with CMP Construction secured

Carpark pre-sales exhausted. All spaces offered pre-sold and 10% deposits received

April 2022

October 2021

Get started and join thousands of investors who choose to partner with Gleneagle

Apply Now

Individual Application

You

If we are unable to electronically verify your identity, you will also be asked to supply two forms of identification:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Joint Application

You and Another Applicant

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Company Application

The Company

Directors and UBOs

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Trust Application

The Trust

Copy of the Trust Deed

This must be certified by a Justice of the Peace

UBOs and Individual Trustees

You’ll need to provide details about the Ultimate Beneficial Owners (UBOs) and Trustee(s).

If we are unable to electronically verify their identities, you will also be asked to supply two forms of identification for each applicant:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Settlor of the Trust

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.

Self Managed Superannuation Fund (SMSF) Application

The SMSF

Pages from the Trust Deed

Front cover page, Schedule page, Signature / Execution page

UBOs and Individual Trustees

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.