Parkview on Cornwall

Auckland, New Zealand

Product Type

Property Loan

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Summary

This secured property loan is to support early works for Stage 1 of the development.

The development is owned and delivered by Gleneagle and its partners

Internally managed project, allowing precision risk management and control

Fixed price construction contract

Desirable site location next to Cornwall Park and Alexandra Park

Proven team of builder, architects and financial sponsors with a strong track record of delivering completed projects

Straight forward build with high-end finishes; well suited to upscale and prestigious surrounding suburbs

Sophisticated Investors

To be considered for this investment product; applicants must supply evidence they qualify as a Sophisticated Investor

Investment Terms

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Borrower | RT Parkview Pty Ltd as trustee for Gleneagle Parkview Trust |

Property Valuation | Land Value: ~NZD$95m estimated post 7 lot subdivision Value on Completion: ~NZD$557m anticipated land, asset and business value |

Investment Loan | Proceeds used to support construction early works and related costs |

Interest | 12% p.a., payable monthly |

Loan Maturity | 31st October 2023 |

Max LVR | 75% |

Investment Close | 30th April 2023 |

Minimum Investment | AUD$50,000 (open only to sophisticated investors within the meaning of section 708(8) of the Corporations Act) |

Loan Repayment | Early repayment allowed at discretion of borrower |

Loan Security | 2nd Ranking Secured Loan Facility comprising an all asset charge over the Borrower and 2nd mortgage over the land owned by the Borrower, behind senior land secured financing of ~NZD$49.1m, and senior construction secured financing ~NZD$167m |

Deed | Investors may request a copy of the trust deed if desired |

Product Code | PARK12P2210 |

Access the Term Sheet

Gain instant access to the term sheet containing the Construction Schedule, Property Valuation and more.

By clicking submit, you agree to the terms of Gleneagle’s Financial Services Guide and to be contacted, in accordance with the Privacy Policy.

Lot 1 | 2931m2 | Lot 2 | 1973m2 |

|---|---|---|---|

Lot 3 | 2593m2 | Lot 4 | 2520m2 |

Lot 5 | 3145m2 | Lot 6 | 2948m2 |

Lot 8 |

5544m2 (Basement Level) | ||

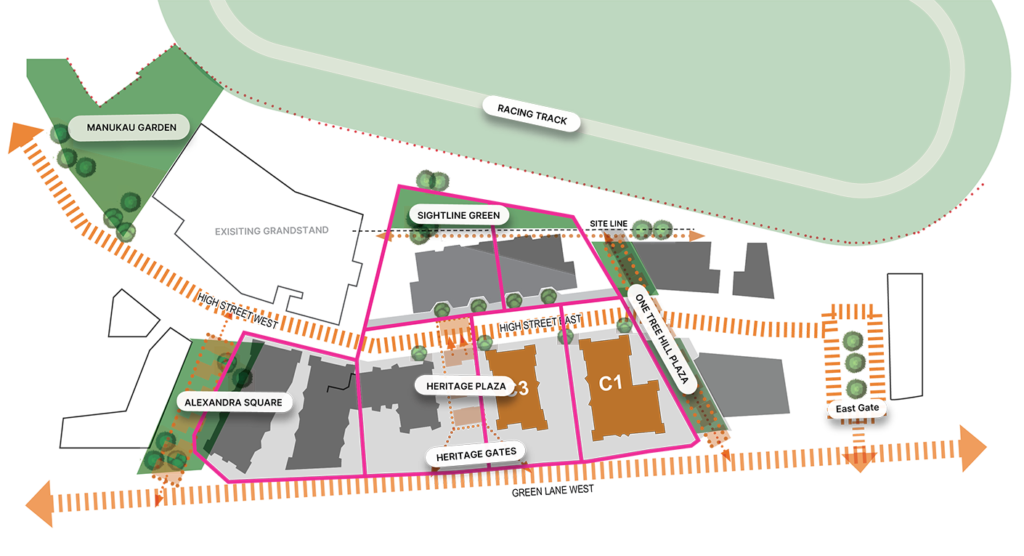

Project Plan & Zoning

The acquisition forms part of a subdivision to Auckland Trotting Club land, known as Alexandra Park

Consent to the subdivision was granted by Auckland Council in March 2022 and 3 individual titles were issued in August 2022.

Consent for this subdivision was granted in November 2022.

Stage 1

Buildings C1 and C3 form the first stage of development, within what is to be known as ‘Parkview on Cornwall’

Managed Luxury Retirement Living

Queen of the Park

The key target population for retirement living are those 75+. In 2021 there were estimated to be almost 345,960 NZ residents 75+ years of age. By 2048, this is forecast to increase by over 140%.

This vast increase adds further weight to the growing demand from residents and their families for premium accommodation options.

Though New Zealand continues to deliver new

units to meet increasing demand, JLL research suggests that demand will continue to outweigh the country’s development pipeline.

Bespoke Residential Apartments

Cardigan Bay

Epsom is a highly desirable suburb, proving particularly popular with families. Parkview is situated on the greenscape of Cornwall and Alexandra Parks and is within Epsom’s coveted ‘Double Grammar’ school zone.

Pre-sales for Building C3 the apartments commenced strongly in Q2 2022, with further appreciable sales forecast from the pipeline.

Project Progression

2023 Onward

Investment Open

New loan now open to investors

Proceeds used to support construction of early works and related development costs

Resource Consent granted

Resource Consent granted for ‘Queen of the Park’ and ‘Cardigan Bay’

Resource Consent granted for further land subdivision into 7 individual lots

Site preparation and construction of early works commenced for Stage 1

Freehold titles

Pre-sales campaign

Architectural plan

Boundary realignment

Ground condition report completed

Preliminary schemes developed

Preliminary Geotechnical boreholes completed

Get started and join thousands of investors who choose to partner with Gleneagle

Apply Now

Individual Application

You

If we are unable to electronically verify your identity, you will also be asked to supply two forms of identification:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Joint Application

You and Another Applicant

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Company Application

The Company

Directors and UBOs

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Trust Application

The Trust

Copy of the Trust Deed

This must be certified by a Justice of the Peace

UBOs and Individual Trustees

You’ll need to provide details about the Ultimate Beneficial Owners (UBOs) and Trustee(s).

If we are unable to electronically verify their identities, you will also be asked to supply two forms of identification for each applicant:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Settlor of the Trust

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.

Self Managed Superannuation Fund (SMSF) Application

The SMSF

Pages from the Trust Deed

Front cover page, Schedule page, Signature / Execution page

UBOs and Individual Trustees

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.

CMP Construction

CMP Construction offer over 30 years’ experience as a successful Auckland construction company specialising in large commercial and industrial developments. CMP specialises in large-scale new commercial buildings – multi-storey apartments and offices, industrial and warehouse buildings.

Frequently Asked Questions

This project meets Gleneagle’s strict investment criteria, and we are uniquely placed to capitalise on development opportunities, regardless of their geographic location.

We have a strong track record in delivering similar projects in New Zealand and have a close working relationship with all consultants involved, (both in Australia and New Zealand.)

Where specifically noted, some financial figures have been reported in the project’s local currency – New Zealand Dollars (NZD).

However, Gleneagle is an Australian Financial Institution. Your investment in this product, respective interest payments made to you, and any reporting or statements provided to you, will always be in Australian Dollars (AUD).

Investors will subscribe for an allocation of units in the GE Parkview Lending Trust (1 Unit per $1 AUD Invested).

When interest is paid on the loan each month, the trust distributes that interest to investors, proportionate to the number of units they own.

This structure simplifies otherwise complex requirements relating to GST and withholding tax on interest.

Investors are paid interest monthly.

Interest is paid and statements provided to investors on a monthly basis.

This product is open only to sophisticated investors (within the meaning of section 708(8) of the Corporations Act). Learn more about qualifying as a Sophisticated Investor here.