The Club

At Parkview on Cornwall

Product Type

Property Loan

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Summary

Parkview comprises over 16,000m2 prime land in Epsom, Auckland, one of New Zealand’s most prestigious suburbs

The development is owned and delivered by Gleneagle and its partners.

Stage 1 of the master plan comprises delivery of ‘The Club’ on Lot 2.

This loan allows eligible investors to co-invest with Gleneagle, via a registered 2nd mortgage.

Funds will contribute toward early works and land refinancing of Lot 2.

Land refinancing is scheduled to conclude Q2 2024, at which time Gleneagle will offer a registered 1st mortgage over Lot 2 (‘The Club’).

Investors in this product reserve the right to novate their units into the 1st mortgage at that time. Refer to the terms for more information.

Master Plan and Zoning

The Parkview development forms part of a subdivision to Auckland Trotting Club land, known as Alexandra Park

Consent to the subdivision was granted by Auckland Council in March 2022 and 3 individual titles were issued.

Current Titles:

Lot 1 | 4,873m2 | 1049333 – Greenlane West, Epsom, Auckland | |

|---|---|---|---|

Lot 2 | 6,519m2 | 1049334 – Greenlane West, Epsom, Auckland | |

Lot 3 | 4,714m2 | 1049335 – Greenlane West, Epsom, Auckland | |

Total | 16,110m2 | ||

Lot 1

Lot 1

Lot 3

Lot 3

All lots are zoned ‘Business – Mixed Use, Activity Areas’

This poses incredibly unique development potential, allowing Gleneagle to capitalise on changing market demands. Parkview’s master plan has been strategised to provide a mix of retail, residential, hotel, senior living and lifestyle offerings, catering to the extensive interest received from both local operators and prestigious international brands.

Sophisticated Investors

To be considered for this investment product; applicants must supply evidence they qualify as a Sophisticated Investor

Investment Terms

Interest Rate

12% p.a

Payment

Monthly

Max LVR

75%

Borrower | RT Parkview Pty Ltd as trustee for Gleneagle Parkview Trust (Borrower) |

Lender | Investors apply for subscription of units in the GE Parkview Lending Trust (Units). Investors may request a copy of the trust deed if desired. |

Use of Proceeds | Land refinancing of Lot 2 and early works for Lot 2 (‘The Club’). Refinancing of Lot 2 is scheduled to conclude in Q2 2024, at which time Gleneagle will offer a registered 1st mortgage over Lot 2. |

Property Value | On Completion of ‘The Club’ on Lot 2: >$217.3m NZD anticipated net asset realisation (less GST) Residual land value of Lots 1 & 3: $46.9m NZD Note: Figures only incorporate value brought by development on Lot 2. Does not consider the value of future stages detailed in the master plan (across Lots 1 and 3), nor the value of approved subdivision into 7 lots. |

Loan Security | 2nd ranking secured loan facility comprising an all asset charge over the Borrower and registered 2nd mortgage over Lots 1, 2 and 3. This security ranks behind senior financing currently drawn to ~$52m, which will be further drawn down, in conjunction with the construction schedule. |

Right of Novation | A registered 1st mortgage over Lot 2 (The Club) is scheduled to become available in Q2 2024. Investors reserve the right to:

|

Max LVR | 75% |

Interest | 12% p.a., payable to investors monthly |

Loan Maturity | 31 October 2024 |

Minimum Investment | AUD$50,000 (open only to sophisticated investors within the meaning of section 708(8) of the Corporations Act). |

Loan Repayment | Early repayment allowed, at discretion of the Borrower. |

Gleneagle Code | PARK12P2312T2 |

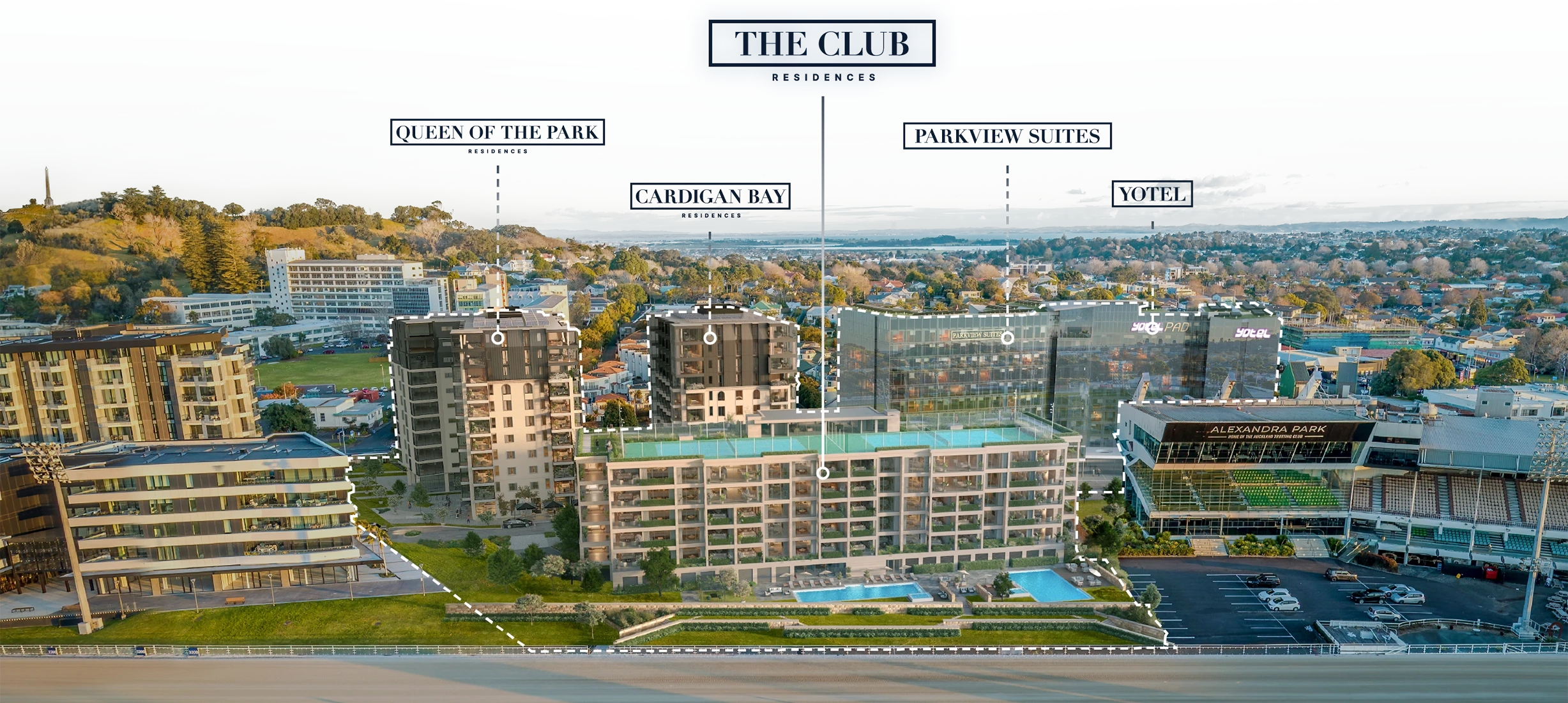

Project Staging

Stage One

The Club

Luxury Apartments

Stage Two

YOTEL

Luxury Smart Hotel

Stage Three

Queen of The Park

Managed Luxury Retirement Living

Cardigan Bay

Bespoke Residential Apartments

Stage Four

Virgin Active

Luxury Gym Facility

Parkview Suites

Serviced Apartments

Get started and join thousands of investors who choose to partner with Gleneagle

Gain access to the term sheet containing Stage 1 Schedule, Project Financials and more

The Club

Lot 2 - 6,519m2

This loan allows eligible investors to co-invest with Gleneagle via a registered 2nd mortgage. Proceeds will be used to support land refinancing and early works for Lot 2 (The Club).

Refinancing is scheduled to conclude Q2 2024, at which time Gleneagle will offer a registered 1st mortgage over Lot 2.

Investors in this product reserve the right to novate their units into the 1st mortgage at that time. Refer to the terms for more information.

Apply Now

Individual Application

You

If we are unable to electronically verify your identity, you will also be asked to supply two forms of identification:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Joint Application

You and Another Applicant

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Company Application

The Company

Directors and UBOs

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Trust Application

The Trust

Copy of the Trust Deed

This must be certified by a Justice of the Peace

UBOs and Individual Trustees

You’ll need to provide details about the Ultimate Beneficial Owners (UBOs) and Trustee(s).

If we are unable to electronically verify their identities, you will also be asked to supply two forms of identification for each applicant:

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Settlor of the Trust

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.

Self Managed Superannuation Fund (SMSF) Application

The SMSF

Pages from the Trust Deed

Front cover page, Schedule page, Signature / Execution page

UBOs and Individual Trustees

Photo ID

Current driver’s license, passport or national ID card

Proof of Address

Utility bill or bank statement from the last 3 months

Corporate Trustee

If the trustee is a private or public company, you will be asked to supply details about the company.